Brandon and Kate tackle the big question on everyone’s mind: are Bitcoin treasury companies finally about to pump our bags, or are they still a structural risk to the market? They walk through fresh announcements from corporate buyers, revisit earlier fears about debt-fueled treasury strategies, dig into why Bitcoin DeFi still matters no matter what price does, and close with stablecoin risk, Tether’s downgrade, and an upcoming sBTC giveaway with Zero Authority.

Topics Discussed- 🎯 Whether this new wave of Bitcoin treasury companies is different from the last cycle

- 🏢 How leveraged treasury strategies could create cascading sell pressure if BTC dumps

- 📈 New announcements that suggest some treasury companies are finally executing

- 🧠 Why “Bitcoin needs DeFi” regardless of ETF flows or treasury narratives

- 🏦 S&P’s downgrade of USDT/Tether and what it says about stablecoin reserve risk

- 💵 The role of stablecoins vs. BTC as pristine collateral in a BTCFi world

- 🧱 Recap of last year’s milestones like Nakamoto and sBTC going live, and what’s coming next

- 🎁 Upcoming sBTC giveaway and a Zero Authority episode on on-chain reputation

Chapters- 00:00:22 — Cold open, technical gremlins, and Friday vibes

- 00:03:02 — Looking back: Nakamoto, sBTC, Circle, and a busy year for Bitcoin L2s

- 00:07:45 — Why debt-fueled Bitcoin treasury companies used to be scary

- 00:12:52 — Are Bitcoin treasury companies finally about to execute and buy BTC?

- 00:16:27 — Bitcoin as DeFi: lending, borrowing, and trading BTC regardless of price

- 00:17:04 — S&P downgrades USDT/Tether and re-prices stablecoin risk

- 00:21:55 — Announcing an sBTC giveaway with Zero Authority

- 00:22:21 — How to participate and where to find Zero Authority DAO

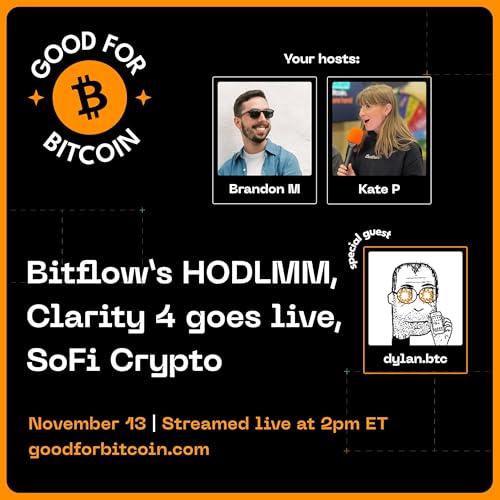

Good For Bitcoin is hosted by Brandon Marshall (@marshallmixing) and Kate Parkman (@katemparkman).

🎧 Subscribe: goodforbitcoin.com

📺 Watch: YouTube

🎙️ Listen on: Spotify • Apple Podcasts • Amazon Music • Pocket Casts

📰 RSS: anchor.fm/s/f9f164f0/podcast/rss

Dec 12 202551 min

Dec 12 202551 min 21 min

21 min 38 min

38 min 54 min

54 min 39 min

39 min 43 min

43 min 31 min

31 min 43 min

43 min